Business, national or global, is an ever-growing network of traders and consumers involved in the...

STAY INFORMED

Blogs About GST, Accounting & Business Operations Management

Steps to Improve Receivables Management

The biggest challenge faced by any large or small business, more than sales, branding or...

IT Department’s Move to Charge Higher TDS for Non-Filers

According to the Budget 2021, the non-filers of income tax for the last two fiscal year will be...

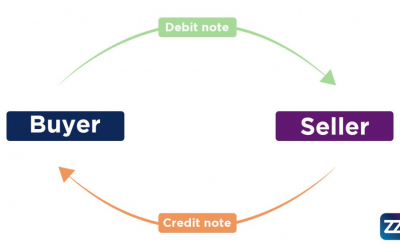

When is Credit and Debit Note Issued?

Maintaining legally compliant, professional invoices is imperative to the operations of any...

HSN Code Made Mandatory On GST Invoices From 1st April 2021

As per the notification issued by the GST authorities in October 2020, the HSN codes are now...

What is HSN Code in Invoice? The Importance of HSN Code

The sprawling nexus of trade worldwide involving umpteen products, services, manufacturers,...

Importance of Real-time Tracking of Accounting Transactions

Gone are the days when people used to go through loads and loads of ledgers and financial...

How can a free Chartered Accountant seat help in efficiently filling GST?

Cloud accounting software is the best investment to scale your business. You can easily...