The GST council of India has completed three years of the GST regime. However, the government is still striving to address various issues and concerns to build a sound taxation system. While the government was resolving downsides concerning the impact of GST on the Indian economy, the COVID-19 pandemic has worsened it.

The GST council of India has completed three years of the GST regime. However, the government is still striving to address various issues and concerns to build a sound taxation system. While the government was resolving downsides concerning the impact of GST on the Indian economy, the COVID-19 pandemic has worsened it.

The global pandemic has wrecked the world’s economy. Several countries are striving to cope with the impact of COVID-19 on businesses. India’s government has notified several economic relief measures, and tax calculation changes for companies registered under the Goods and Services tax regime.

Concerning the ongoing crisis, experts believe that the chances of businesses experiencing negative growth in India are extremely less. Currently, enterprises are resuming in the country, and the economic growth trajectory will be restored by 2021. The government is primarily focused on the GST implications of COVID-19.

In this article, you will read more about the potential impact of GST on the Indian economy during the COVID-19 pandemic.

GST Implications Amid COVID-19

The deadly COVID-19 pandemic has led to the loss of innocent lives, steepening the economy globally. It has left people with no shelter, food, job, or hopes. The severe economic impact has collapsed various industries and businesses.

The pandemic has created a new world of uncertainty. The economic standstill is said to recess a large part of the world. Several countries were striving to recover the low economic growth of 2019 in the current year. But COVID-19 has made it impossible for individual countries to stand back again.

The good news is India has always had fast recovery concerning the economic crisis in the past. Industries, large enterprises, and small businesses in India are hoping for a quicker economic recovery in this case as well. Here are some of the GST implications notified by the government during COVID-19.

Extended Due Dates

The finance minister, Nirmala Sitharaman, announced the extended due dates to File GST compliance. The government took up a step by step implementation of the new announcements. The ordinance was brought on 3rd March 2020, followed by the notifications released on 31st March 2020.

Besides, the GST council also released several relief measures to provide relaxation to businesses. The government made it mandatory for businesses to e-invoice the GST tax invoice format to simplify filing GST returns. The notifications and circulars issued on 3rd April 2020 came with several benefits for delayed returns filings and other provisions under the GST regime.

We have listed the extended due dates in detail. Click here to know more about updated due dates and other tax calculation changes during COVID-19.

Note: Under circumstances where returns are filed after the beneficial dates given by the government, late fee along with an interest rate of 18% will be charged. It is vital to know that the extended due dates are applicable only for the current fiscal year. These benefits are not notified under the Income Tax Act (ITA).

Impact of GST on Indian Economy – Ongoing Contracts

Concerning the ongoing contracts, there are several cancellations or reductions in prices due to the impact of GST on the Indian economy. Below mentioned are pointers of the same.

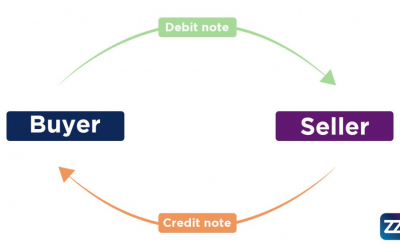

1. Goods: Credit Notes for Goods Returns

Under the newly notified GST announcement, Income Tax Credit or Credit notes can only be claimed if the reverse ITC amount of the recipient is available on the GST portal in GSTR-2A.

Taxpayers can issue credit notes within six months from the end of the fiscal year or on the date of filing annual returns. It is up to the convenience of the taxpayer. However, a credit note cannot be issued if the taxation on specific supplies mentioned has been passed to some other person.

In case there is no tax liability, taxpayers can avail of the refund. A credit note against the same has to be adjusted accordingly.

2. Goods: Posts Sales Discount

To avail post-sale discounts, several enterprises are entering the supplementary contract or agreements. Thus, customers demand negotiation before processing the final payments.

Business owners must make note that agreements applicable for any discounts must be pre-notified before or at the time of the supply of goods. Thus, any negotiations or supplementary contracts made effective after the sales can be challenged by the department.

3. Services: Credit Notes

For services, taxpayers can issue credit notes for taxable value or tax charged. The same must be issued under the tax invoice for deficiently supplied services.

Enterprises must provide evidence before the department explaining the reason why they require a downward revision in prices. They should justify the circumstances that led them to the same. Under such circumstances, small business owners can avail of a refund with the approval of the department.

4. Services: Advances Received for Services on Contracts Cancelled

The GST liabilities must be discharged on advances received on services in the prior of receipt. In case the contract is canceled after receiving the advance, the assesses can either claim refund or adjust the advance tax against liability. A tax refund is available under such circumstances.

Impact of GST on Indian Economy – Income Tax Credit (ITC) Implications

1. Income Tax Credit (ITC) Incurred to Rid from the Impact of COVID-19

Enterprises have decided to incur their expenses to combat COVID-19. The government has provided a directive for business owners to incur a particular expenditure along with expenses. For instance:

- Employee Health insurance

- Personal Protective Equipment (PPE) and Sanitizers

- Costs incurred for allowing employees to work from home

- Capital expenditure

Note 1: The business owners must know that each expense will be examined before its allowability. For instance, health insurance is not allowed under the GST Act unless provided as per the government’s notification.

Note 2: Business owners must maintain documentation to justify the need for expenses incurred.

2. Reversal of ITC for Not Paying Suppliers Within 180 Days

The due dates are extended. The government has not provided clarification regarding the reversal of ITC if suppliers aren’t paid within 180 days. However, if the government offers any such explanations, business owners will have to take a call accordingly.

In case the limit of 180 days exceeds the due date, it is evident that no extension will be applicable concerning the terms and notifications mentioned above.

3. Reversal of ITC on Obsolete Inventory

Business owners must reverse the goods that are destroyed, disposed, or written off. Enterprises must maintain accurate documentation for appropriate obsolete inventory form and reverse ITC at the same time when filing returns.

4. ITC on Goods Sold at Loss

During the COVID-19 pandemic, many businesses had come to a standstill. They were selling under distress. If enterprises have accurate documentation on goods sold for a lesser price, they can claim for refund.

5. Goods sent for Job-Work.

When inputs are sent to job work without tax payment, the principal is liable to pay tax and applicable interest for the unpaid period. The same applies to goods sent for job work. It is recommended that business owners apply for a time limit extension on reviewing the status of capital goods and inputs sent to job work.

Review of Existing and Future Contracts

Business owners must review all their existing contracts. Taxpayers must undertake the review of possible impacts of clauses and obligations in the agreement concerning the following:

- Suspension of work clause

- Discount clause

- Notice clause

- Force Majeure clause

Conclusion

We tried to envisage the potential impacts of GST on the Indian economy during COVID-19 in a nutshell. Currently, the country is stepping back to the normal with the nation-wide lift of lockdown.

Business scenarios are rapidly evolving. Thus, the impact of GST on the Indian economy might change direction amid ongoing changes brought due to COVID-19. The consequences mentioned above can be used as guidance for now. However, the GST implications can differ from case to case.

It is recommended that business owners maintain accurate documents concerning each bank transaction. Only then can a business benefit from the temporary taxation changes.

At Imprezz.in – Billing software for GST, we understand it is nerve-wracking to track all financial records. We provide a 14 days free software trial program on our accounting software for small businesses in India.

E-invoicing is made hassle free with Imprezz accounting solutions. Avail exclusively tailored invoice template to E-invoice GST. Imprezz, the best accounting software allows you to file GST returns in just a few clicks.

You can manage all your manual bookkeeping tasks under the cloud. Access your financial data, manage your accounting tasks, create invoices from anywhere during these tough times.

Log-in to our online quote creator software to experience touchless inventory management. Enjoy the benefits of free invoicing software along with reaping the benefits of GST amendments amid COVID-19.