Managing large stock of inventory is a time-consuming process for small business owners such as retailers and online sellers. Sending quotations to making purchases to keep track of inventory and fulfilling current orders can be a daunting process, mostly if you use manual and inefficient stock management methods.

Inventory Management

Inventory management is an important process in any organization to meet the demand of customers. Both excess and deficit stock levels can result in a loss for a business. The moment goods arrive in the store, inventory management helps to receive, count, sort, and arrange the stock efficiently.

The right inventory management tool helps reduce the chances of storing excess inventory, which ultimately reduces the holding cost. Similarly, the organization no longer has to worry about inventory shortages because of the constant supply.

Keeping track of inventory can be a tedious task if you lack automated and efficient inventory control software. Fortunately, we have got this sorted, and Imprezz has recently introduced an inventory management software that will help you save your time and efforts by managing your inventory effectively. As your business expands and grows, Imprezz inventory management software will make it more simple to keep track of your stock.

Let’s deep dive into the Imprezz inventory management systems and help you understand step-by-step how to manage your inventory :

1. Sign Up for Imprezz

The very initial step to begin with Imprezz is to sign up with your credentials. Enter your email address to start. Once you submit your email address, you receive a FOUR-PIN OTP on your email; enter it to confirm.

Once you enter your email, you’ll be asked to create a strong key password consisting of a minimum of 8 words, including the Uppercase. Moving ahead, you’ll be asked to submit answers to a few questions such as What is your business type – Sole propertiership, Partnership, Joint Venture, etc.? The annual income of your business and lastly, your contact details to send OTP and other verification details.

Upon completing the entire process, you’ll be redirected to the main page, and you are ready to go.

2. Sign in for Imprezz

If you are already an existing user of Imprezz and using their invoice generation, accounting feature you can directly login to Imprezz with your email id and password. If you don’t remember your password, you can click the forgot password option on the page to reset your password. Once you log in with the existing credentials, you are ready to go.

3. Locate Inventory Management Feature

Once you log in with your credentials, you’ll move to the main page where you’ll find different sections such as Start, Dashboard, Quotations, Invoices, Contracts, Articles, Expenses, Purchase Orders.

Click on the start button where you’ll find an option for inventory management. The inventory management feature has two main categories: Create Article and Stock Movement.

Let’s first understand the meaning of the term article and what is stock movement?

The term ‘Article’ is used for every item that the company stores to meet the requirements of the customers. For instance: Pen, Bread, etc. are different articles that companies procure and store for deliveries to the end consumer.

Stock Movement refers to the movement of stock ‘in and out’ of the company due to sale to the customer, sale and purchase return, transfer, or stocking in inventories.

These two categories are important components of inventory management and we’ll discuss them in detail.

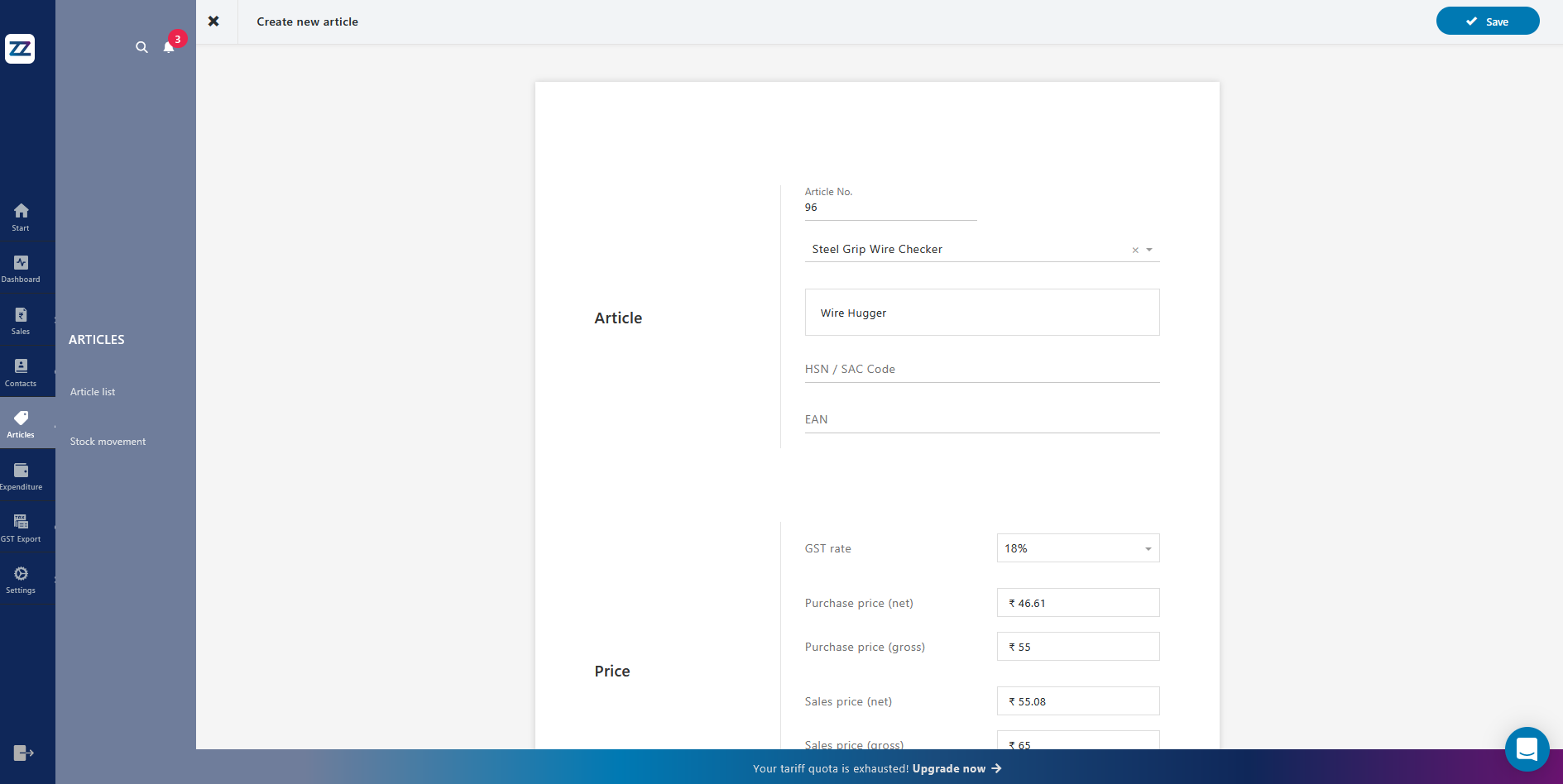

4. Create Article

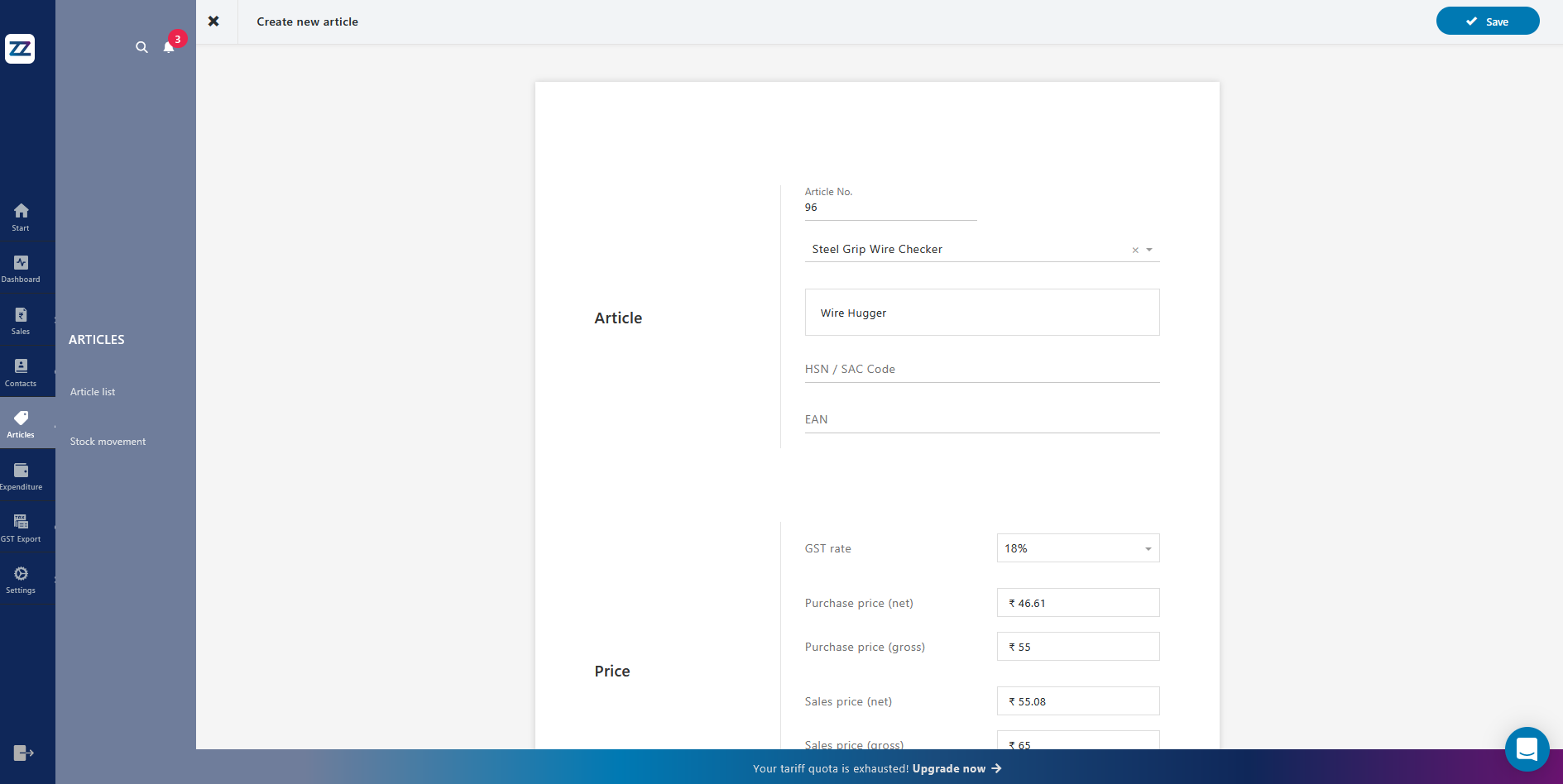

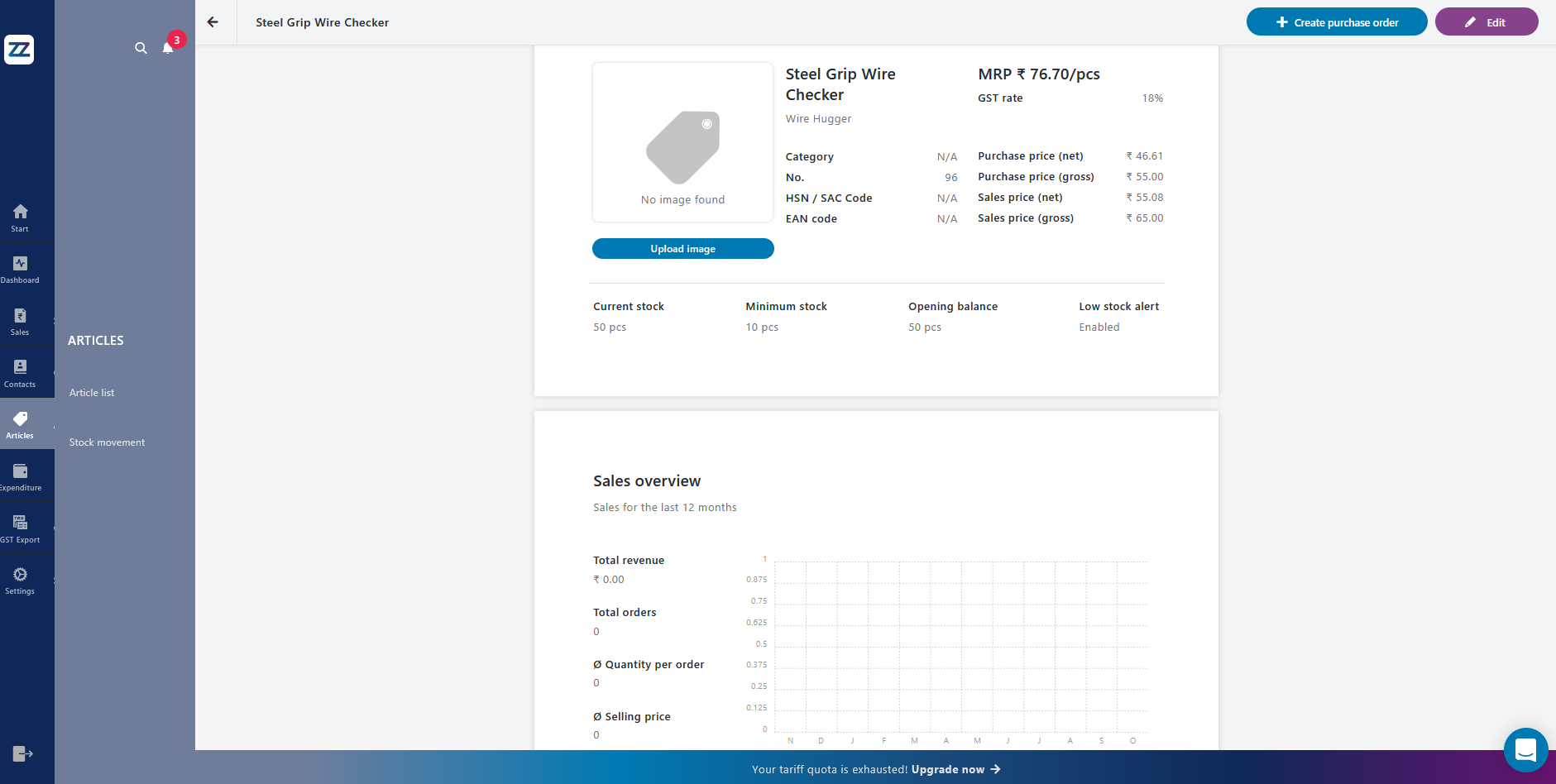

The very initial step in inventory management is to create an article. Enter the number and name of the item purchased. Below the name, enter the description of the article, which can include the relevant information about the article you might need at any point in time. Later enter HSN/SAC Code.

HSN code is a 6-digit universal code that classifies 5000+ products and is accepted worldwide.HSN refers to Harmonized System of Nomenclature code used for classifying the goods under the GST (Goods and Service Tax). The SAC code refers to Services Accounting Code under which services that fall under GST are classified.

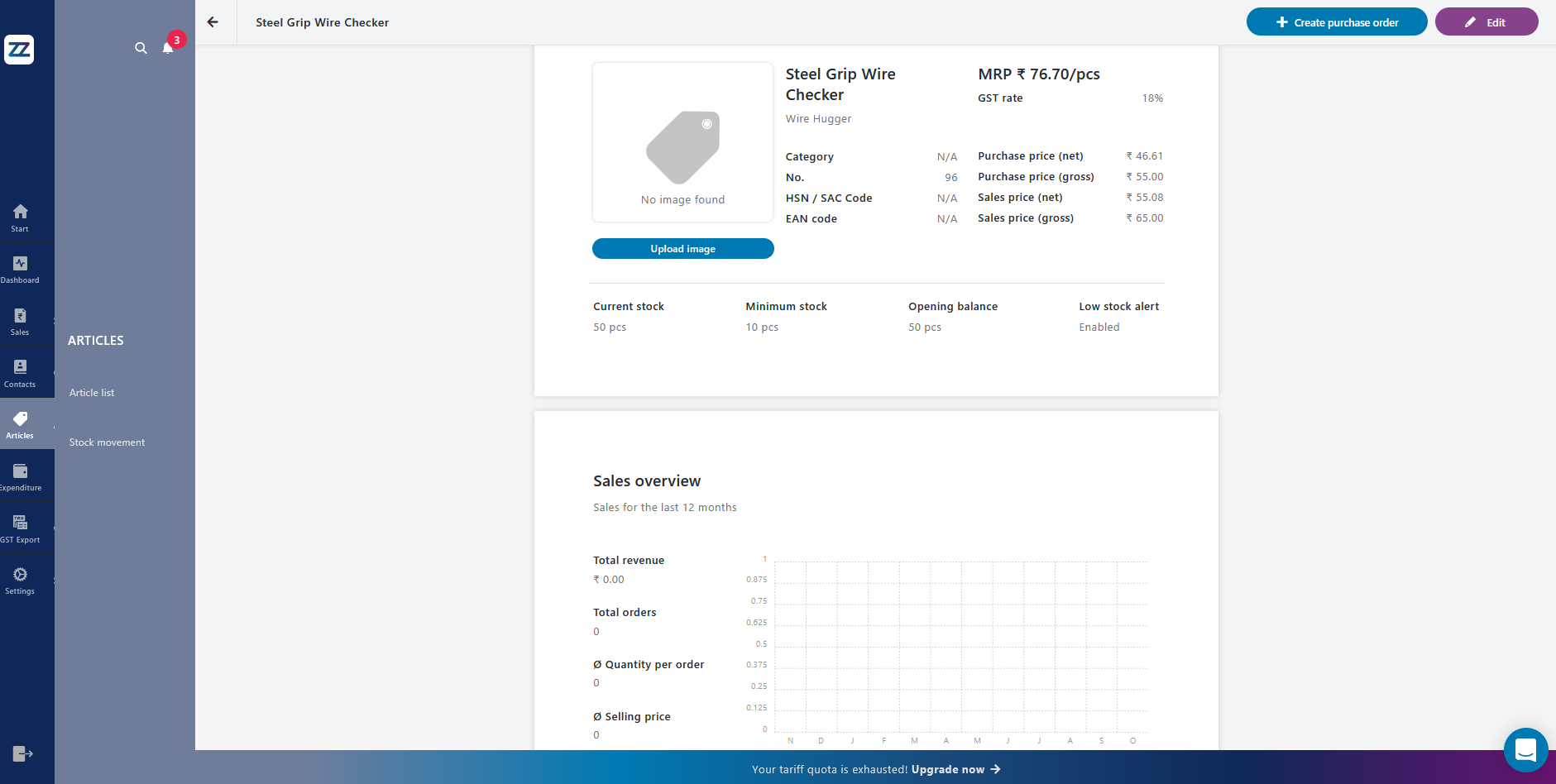

Once you create an article, the next step is to enter the prices. Initially, select the GST rate from 0-28%, followed by the purchase price (net) and purchase price (gross). Below that, enter the details regarding sales price (net) and sales price (gross).

The net purchase price is the value at which the product is sold after all the taxes and costs with all discounts subtracted.

The gross purchase price means that the price that you set for a product or service and is reflected directly in your invoices.

For instance: In the example above you see the net purchase price is Rs.25 which is after deductions made to the gross purchase price of Rs.29.50.

The net sales is the amount calculated from the gross Sales after deducting all the allowances and discounts.

The gross sale is the total unadjusted sales of a business before discounts, allowance, and returns.

For instance: In the image above you find the net sale price is Rs.28 which is after deductions made to the gross sale price of Rs.33.04.

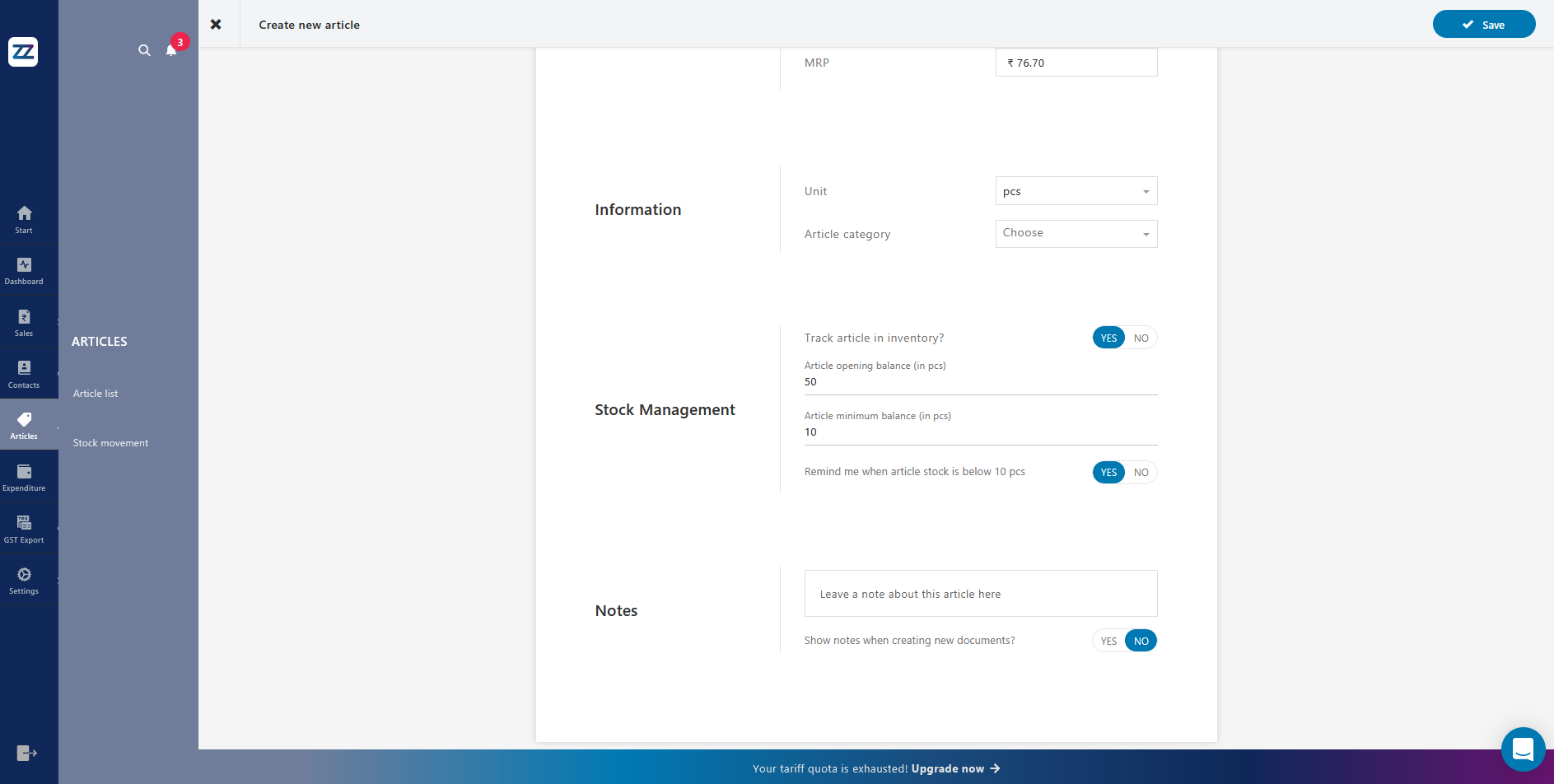

The next step you will see is to enter the information regarding the article. This information includes the number of pieces purchased for a particular article. Next, select the article category from Non-specified, Design, Equipment, Spare parts, Programming, and Consulting.

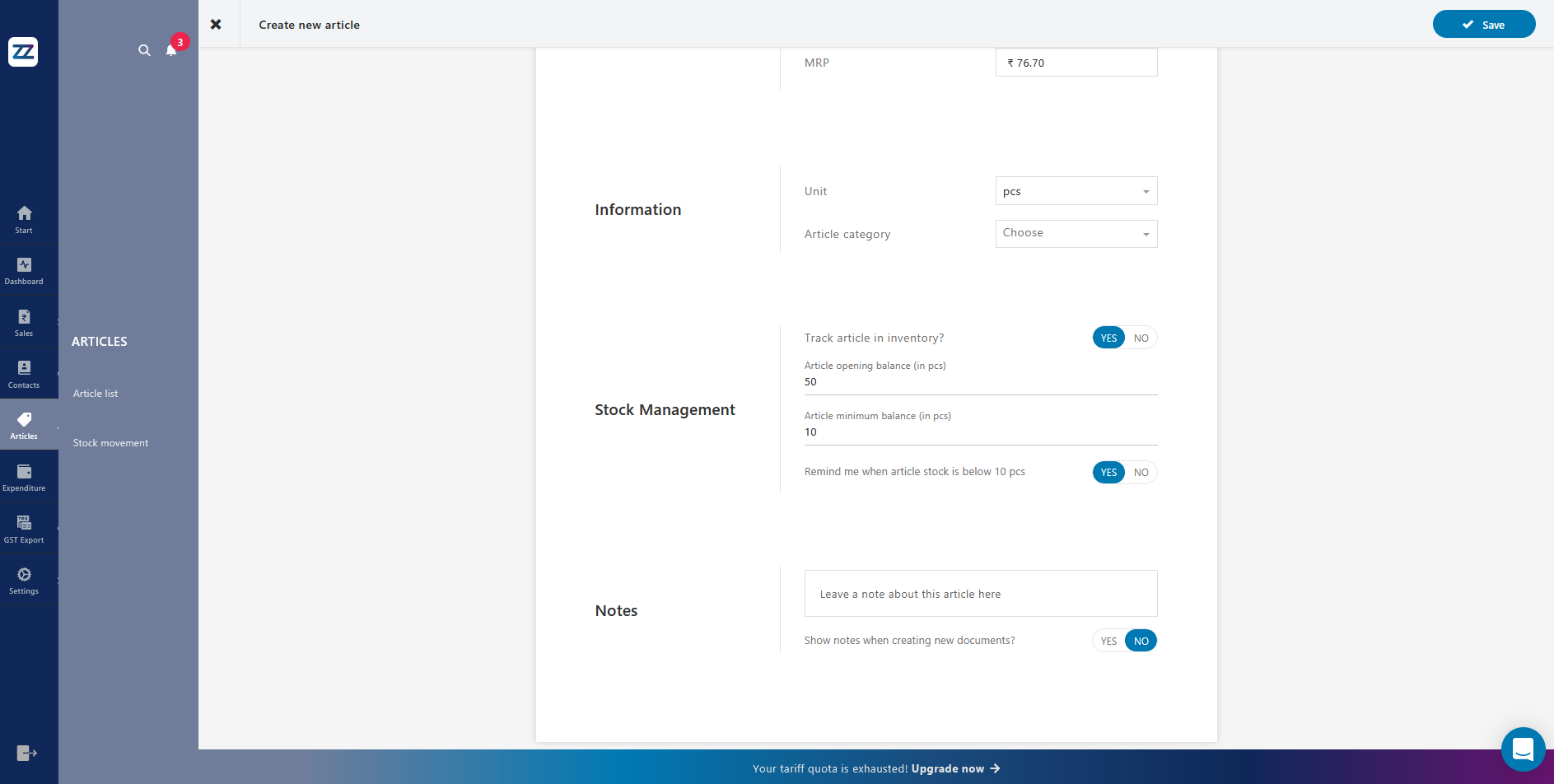

Once you enter the required information about the article, it brings you the option of stock management. You’ll be asked to choose from a choice of yes or no. If you want to track the article in inventory, press “yes,” otherwise press “no.”

Why is it important to track articles in inventory? It is very important to keep a track of your stock to understand the level of articles in your inventory.

Once your stock goes below the required level, the Imprezz inventory management tool will send you a notification and reminder on your e-mail. Any changes made to the article i.e, sale or purchase will automatically make the changes in the entire tool. For instance, if an article is sold it the changes will be made automatically in the whole inventory.

You can also create additional notes for an article for your own reference. You’ll be asked to select from an option of yes or no, whether you want to show notes when creating new documents.

These notes for the article are important for the reference of both you and the payee. Remember before you move to the next step, click the save button to record the details of the article.

You can manually add the ‘n’ number of articles on the tool. For instance: Once you save the details of Article 1’, visit the ‘Add article’ option again

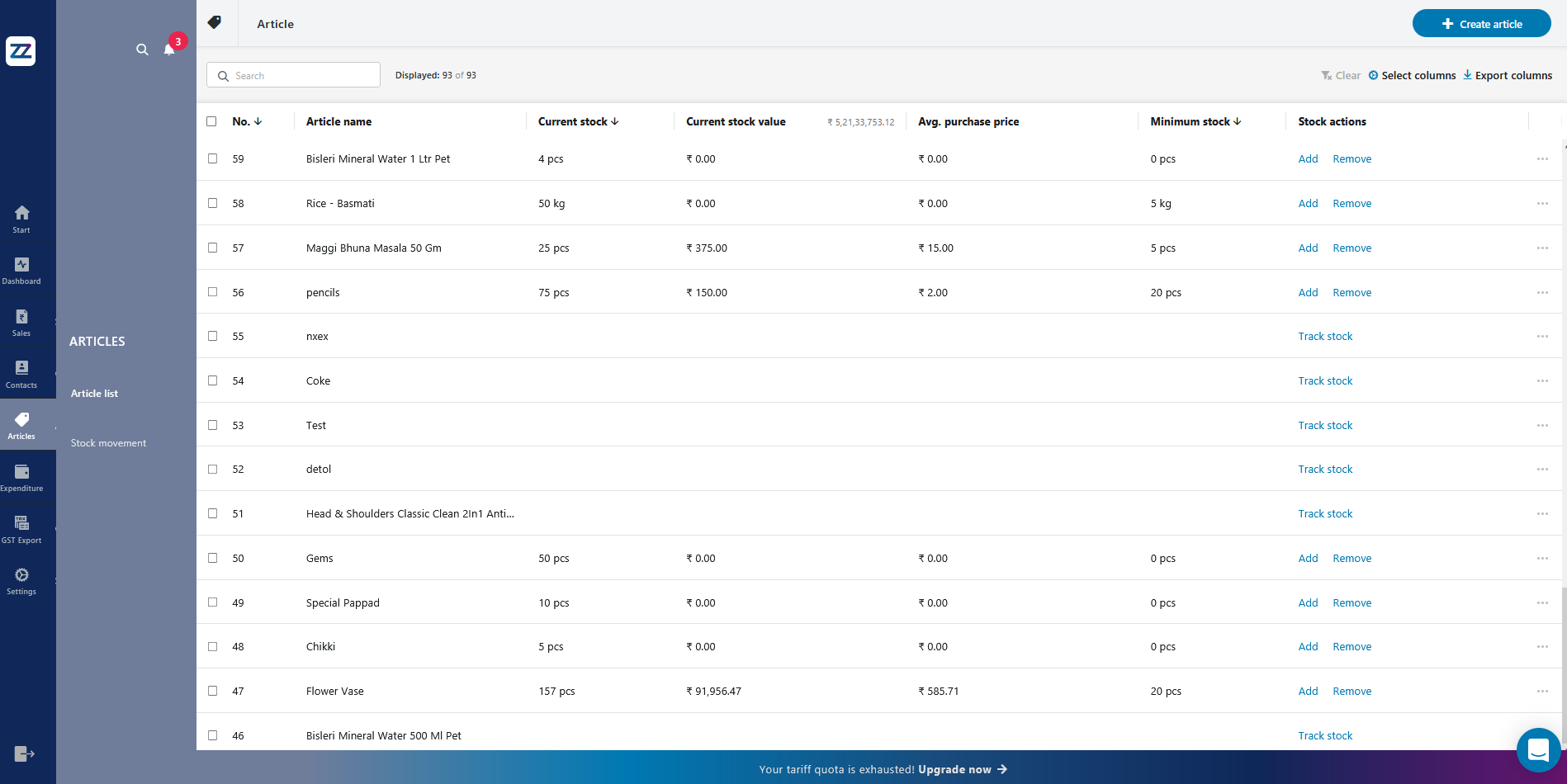

4. Article List

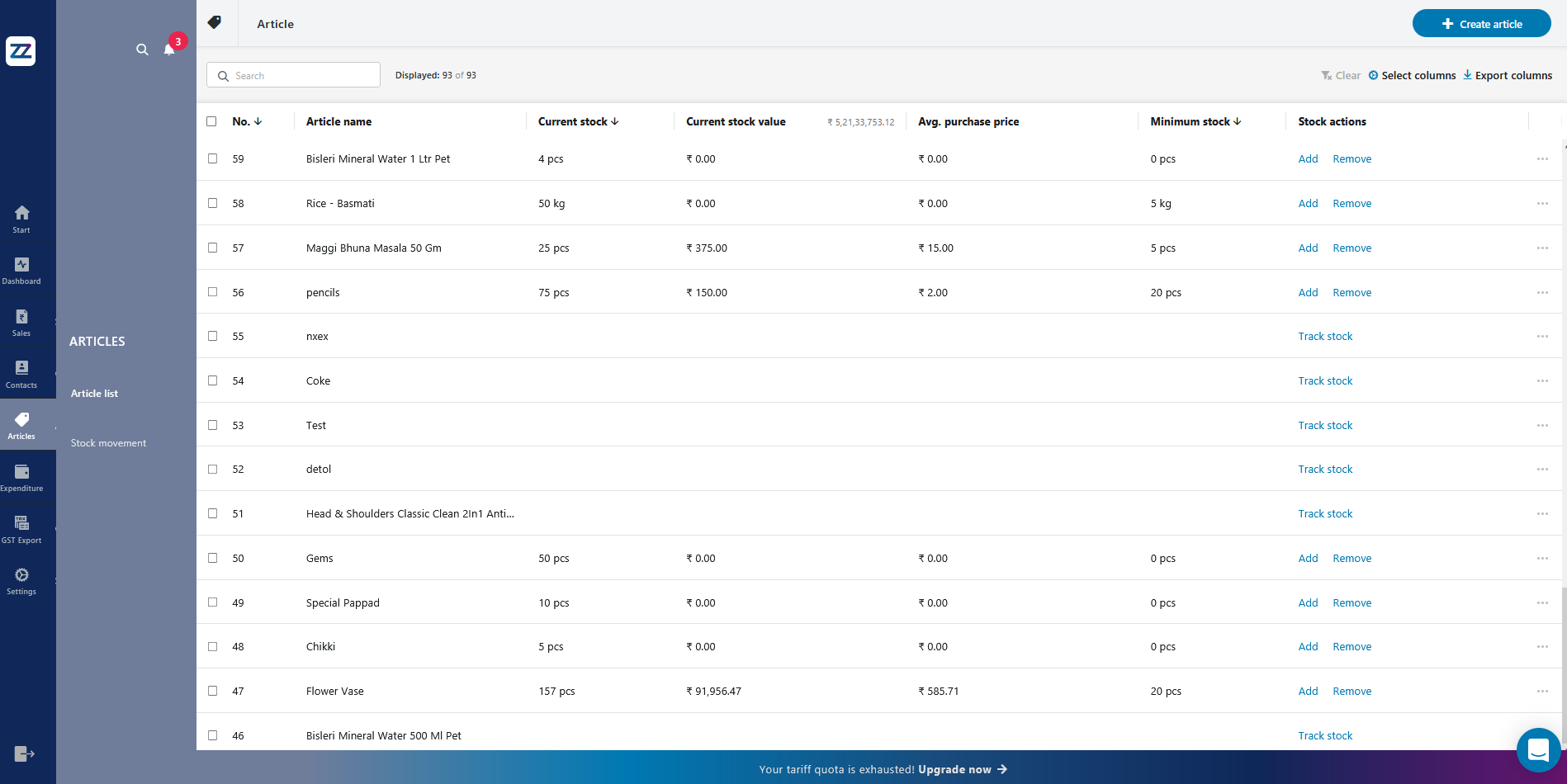

Once you enter the details of the articles, you move to the list of articles that you have created in one place. You no longer have to track every article individually; rather, find them assorted at a single place.

Supposedly, you want to track a particular article, instead of going through the entire list, enter the name of the article in the search bar, it will automatically detect the article. This feature allows you to save a lot of time and effort.

There are different columns in the article list. Let’s have a glance at them and why are they important?

The first column has the ‘article no.’, therefore it is important to clearly state Article no. while creating one. This will avoid any further confusion. Next is the name of the article which was entered in the previous step.

The third column clearly states the current stock, which means the total items available in the inventory. It states the opening balance of the stock.

The next column is the current stock value which means the monetary value of your current stock. This amount is calculated on the basis of current stock * Average price.

The column of Minimum Value indicates the amount of stock level that needs to be maintained. If the stock levels go below that, the tool will send you an alert on the tool with a reminder over your email.

The last column in the Article List is “Stock Action” which is very important. Here you have an option “add or remove” an article. For instance: If you have made a sale of ‘X’ items, choose the option remove and enter the number of items sold. This will deduct the articles from the current stock.

Similarly, if you have made a purchase of ‘X’ items, choose the option to add and enter the number of items purchased. This will add the articles to the current stock.

You can even add or remove columns in the Article list. Click on the option “select columns” in the top left corner, where you can customize your columns. Once you make the changes to the columns, click the save button to make those changes.

On the top left corner, you’ll find an option for “Export Columns” which is similar to your bank balance. This allows you to download the entire article list in an ‘excel format’. You can use this excel sheet for your future reference.

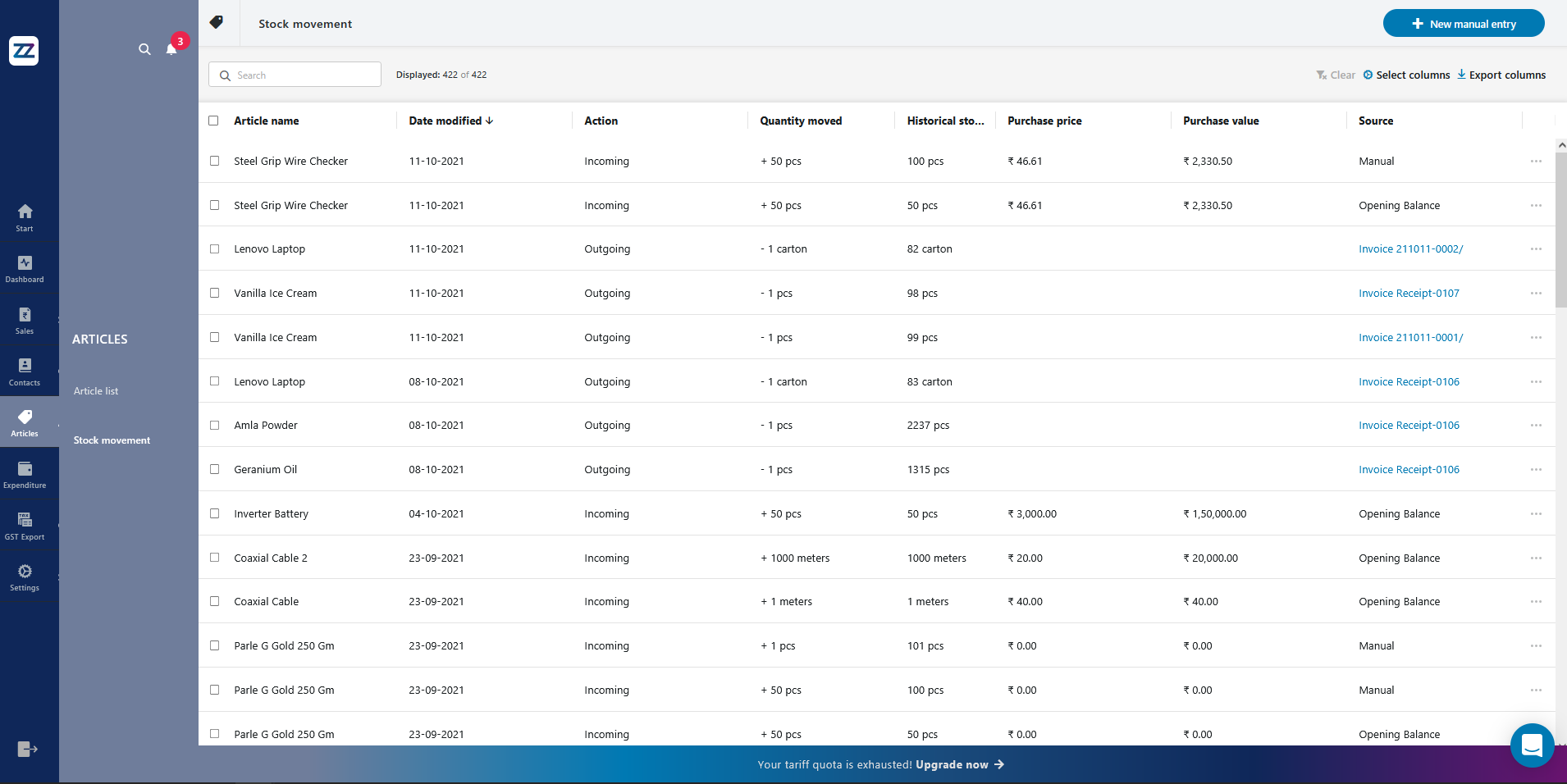

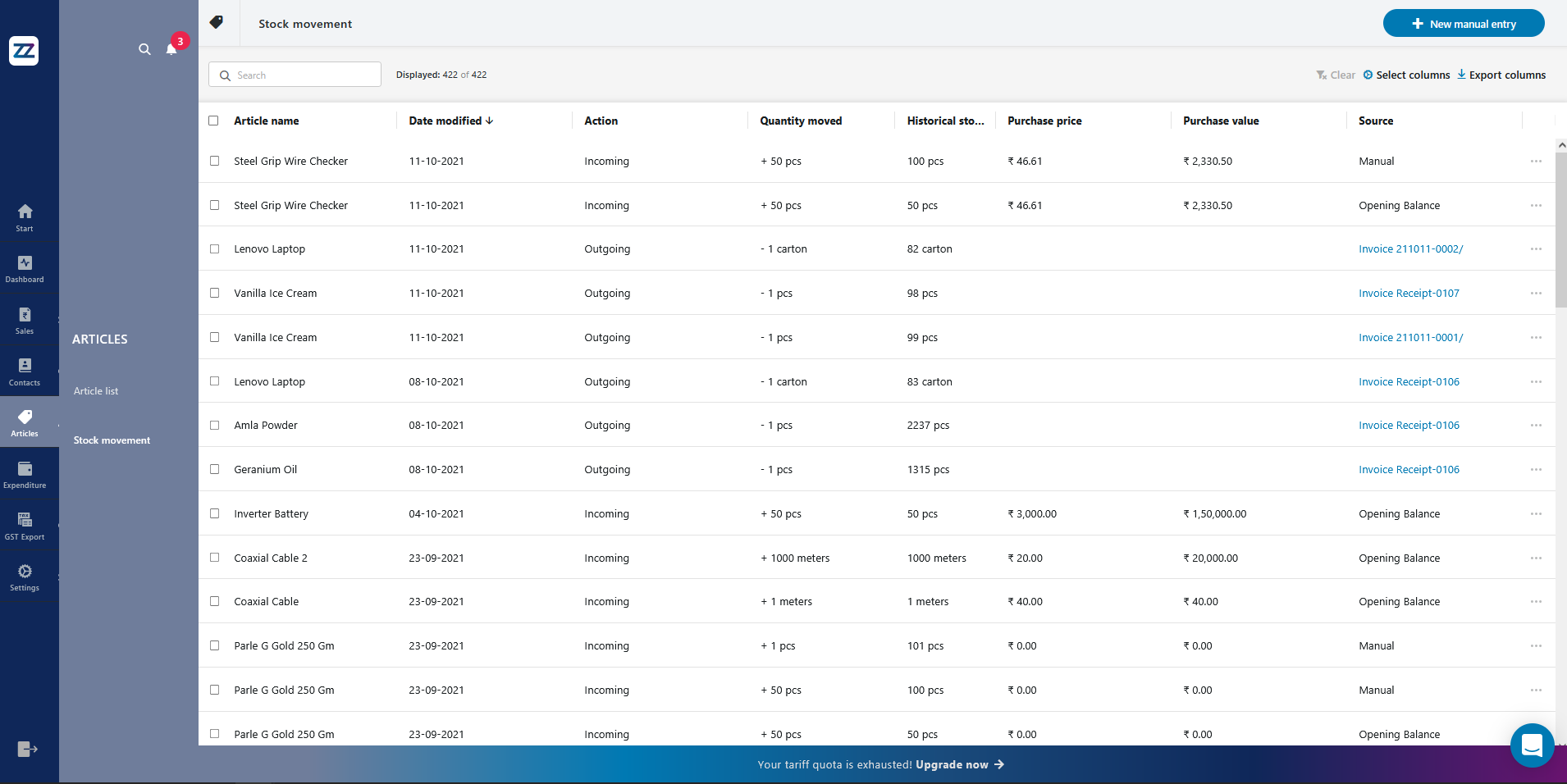

5. Stock Movement

The option of stock movement allows you to track the movement of every single article. Makes sure you have selected the option while creating an article. This will help you keep track of the purchase and sale of an individual article.

The feature helps you assess the movement of stock. The word ‘incoming’ means the number of items purchased and the word ‘outgoing means’ the number of articles sold. The column reflects the changes you made in an ‘Article list’.

Any action of the stock is reflected here. You don’t have to manually track the date on which the changes were made in the stock in the future. The tool does that for you under the option ‘Date Modified’.

It is important to have a glance at the ‘Historical Stock‘ which indicates the previous stock before you made any purchase or sale.

On the top left corner, you can see an option for “Select Columns”. The option allows you to customize your columns. Once you make the changes to the columns, click the save button to make those changes.

On the top left corner, you’ll find an option for “Export Columns” which is similar to your bank balance. This allows you to download the entire article list in an ‘excel format’. You can use this excel sheet for your future reference.

In case, you have forgotten to make an entry you can do it manually, you can do it from an option in the top left corner which reads “New manual entry”.

For you to make a manual entry the very initial step is to select the ‘Article Name”, select the action from incoming (purchase) and outgoing (sales), the quantity purchased and sold. Lastly, enter the net purchase price and sales price and click save. Once you make a manual entry, it will automatically make the change for that particular article on the entire tool.

The best feature of the tool is that it sends you alerts about the total number of articles every time you make a purchase or sale.

Managing your inventory through spreadsheets can be stressful. It hinders the entire workflow. Therefore it is important to have access to all your inventory at your fingertips.

With Imprezz, you can see the inventory in progress. You can create information regarding a new article, access a list of articles in one place, and most importantly, keep an eye on stock movement. With Imprezz, it is easy to track your stocks, automate the process of inventory management, and keep idle inventory flow in the process.

You can automate stock management processes on Imprezz.in. Keep inventory management in just a few clicks. Worry no more; track your inventory with no hassles.

The Goods and Services Tax (GST) implementation has primarily impacted the way start-ups operated in India. It has significantly increased the number of new start-ups in the past three years of successful implementation. The advent of a new tax regime was crucial to abolish various indirect taxes. GST rules for startups were introduced with the slogan “One Nation One Tax” to ease the compliance procedure for MSME, especially for start-ups.

In this article, we have coupled all the necessary information every start-up in India must know. The eligibility criteria for start-ups, the impact of GST benefits for startups, Tax exemptions, consequences of tax evasion, and more!

Eligibility for New Start-ups in India

The start-up India campaign was proclaimed by Prime Minister Narendra Modi in 2016 to encourage entrepreneurs and boost India’s entrepreneurship. The campaign was focused on promoting bank financing, simplifying incorporation processes, granting tax exemptions and providing other benefits to the start-ups.

In India, start-ups can leverage several benefits and exemptions under GST, provided they qualify to be an “Eligible Start-up”. What are the necessary conditions to be met for a new business to be eligible as a start-up? There are various conditions to be fulfilled by a company to become an eligible start-up. As per the Start-up India Action Plan, the following criteria makes a small business idea suitable to become a start-up.

- A business has to be incorporated or registered in India for about seven years (ten years for biotech companies) from the date of incorporation.

- Annual turnover of business should not exceed INR 25 crore in any of the previous financial years.

- An eligible start-up is a business aiming to work towards innovation, invention, deployment and commercialization of business processes, goods or services. Start-ups must be technologically advanced; driven by intellectual property and technology.

- A start-up cannot be formed by reconstruction or break-off of a business that already exists.

- A start-up venture is mandated to obtain an eligibility certificate from the Inter-Ministerial Board setup.

- A start-up can be registered either as a private limited company, registered partnership or limited liability partnership.

Budget 2021 – Latest Update: Tax exemption for start-ups has been extended till 31st March 2022, one more year of the tax holiday.

Impact of GST on Start-ups in India – GST Benefits

The Goods and Services Tax (GST) in India has successfully subsumed all the indirect taxes, curating a unified tax system. As mentioned above, the “One Nation One Tax” regime has created a positive impact on emerging start-ups. Several start-ups across the nation have been enjoying the benefits GST has been offering over the years.

GST Registration – Higher Threshold Limit for Start-ups in India

As per the previous tax system, businesses with a turnover exceeding INR 5 lakh in a financial year (FY) were mandated to register under the VAT system. Since the GST implementation, companies with a turnover exceeding 40 lakh (20 lakh for service providers) in a financial year are mandated to register under the GST regime.

The higher threshold limit under GST aims to provide compliance relief for small businesses, including startups in India. GST regime has also introduced the composition scheme for small businesses and entrepreneurs in India, lowering the amount of tax for start-ups having an annual turnover up to INR 1.5 crore.

Tax Credit on Purchases

Before GST, service-oriented start-ups were supposed to collect and pay service tax to the government. Since most start-ups in India fall under the service industry, non-utilization of VAT paid on business transactions was one of the major concerns. No provisions allowed to claim credits on state VAT amount paid against the service tax liability.

Since GST has bought several indirect taxes under a single tax system, availing Input Tax credits is no longer a matter of concern. Start-ups can now set off taxes paid on their purchases with the taxes p]id on their sales under the Goods and Services Tax (GST) regime.

Hassle-Free GST Registration & Return Filing Procedures

Over the past decade, India has transformed primarily by moving from manual operations to digitalization. Businesses no longer have to run around from one government office to another and submit paper files to obtain a GST registration number. Digital India has made each process a lot simpler and extremely quick. Once all the accounts and records under GST are arranged, getting a registration number is a no brainer task.

Several start-ups undergo the burden to budget-strain; these start-ups can now benefit from the GST regime. Since its implementation, GST has increased the threshold limit for registration and tax credits on purchases. The ease in the return filing processes has brought relief to start-ups and small businesses in India.

Simplified Tax Calculations

Start-ups often work with a constrained budget; they cannot afford to allocate different resources to take care of various compliances under Excise, CST, VAT, Service Tax etc. The GST regime’s advent has instead simplified tax compliance procedures, thus saving time for start-ups to better focus on other business operations.

The digital compliance system in India has increased the scope of accounting software. Imprezz, the GST invoicing and billing software pioneer in India, has been successfully helping small business tax calculations and return filing. Leverage accounting automation, do it all with a click of a button.

It is much easier for start-ups dealing with both goods and services to file single tax returns and pay GST instead of multiple compliances and tax payment. As per the 22nd GST council meeting held on 6th October 2017, Start-ups with annual turnover up to INR 1.5 crore can submit quarterly returns; taxes are paid quarterly. The compliance relief aims to ease the tax burden for small businesses and start-ups in India.

E-Commerce & Online Start-ups in India

Modern start-ups are primarily driven by technology; most innovative start-ups today leverage online presence rather than giving it all into the conventional setups. They transact online, that is, selling products and services through the internet. E-commerce and other online start-ups face no complications regarding the inter-state movement of goods as GST is applicable throughout the country.

Previously, different VAT tax was applicable in different states. For instance, an online website delivering goods to Karnataka must have the registered delivery truck and VAT declaration file for that state. The state’s tax authorities might seize the goods under circumstances where there is a failure to produce necessary documents.

However, states like Rajasthan, Kerala, and West Bengal treat these suppliers as facilitators or mediators and do not require registering for VAT. All these differences in treating supplies usually created confusion in compliances. GST has subsumed all these under a single tax regime to remove the hassle of tax compliance.

Increased Efficiency in Logistics

In India, logistics businesses maintained multiple warehouses across states to rid of the CST and state entry taxes on inter-state movement of goods. Most warehouses operated below their capacity increasing their operating costs. Currently, GST has removed the restrictions on inter-state movement of goods, bringing warehouse consolidation across the nation.

As a result of this, warehouse operators and e-commerce businesses in India show interest in setting up warehouses in strategic locations. It reduces unnecessary logistics costs, increasing the profits early for start-ups involved in the supply of goods through transportation.

Tax Burden on Manufacturing Start-ups in India

Start-ups in the manufacturing industry bear the brunt. Manufacturing businesses with an annual turnover above INR 1.50 crore were liable to pay excise tax as per the excise laws in India. However, GST has reduced this turnover threshold to INR 40 Lakh increasing the tax burden for several manufacturers.

Tax Exemptions under the Start-up India Program

The flawed tax system in India is a story from the past. GST has eradicated all the tax compliance confusion and eased the processes for businesses across the nation. Here are some of the necessary tax exemptions allowed for eligible start-ups in the country.

1. Tax Holiday for About 3-Years in a Block of 7-Years

Start-ups incorporated between 1st April 2016 and 31st March 2021 are eligible for this scheme. However, as mentioned above, budget 2021 has extended the tax holiday for businesses incorporated till 31st March 2022.

These start-ups are eligible to claim a 100% tax rebate on their profits for three years in a block of seven years, provided their annual turnover threshold doesn’t exceed INR 25 crores in any financial year. The scheme aims to help start-ups meet their working capital requirements during the initial years of incorporation.

2. Tax Exemption on Long-Term Capital Gains

Businesses that invest for long-term capital gain in a fund notified by the Central Government within six months from the date of transfer of business assets are exempted from paying taxes on such long-term capital gain under section 54 EE. The maximum amount a business can invest in specified long-term assets is INR 50 lakh. For three years, such amount remains invested in specified funds. In case companies withdraw before the span of 3 years, the exemption will be revoked respectively.

3. Tax Exemptions on Investments Above the Fair Market Value

Eligible start-ups above the fair market value are exempted from levying taxes on investments. These investments include resident angel investors, funds that are not registered under capital venture funds, and family. Any investments made by the incubators above the fair market value is also exempt.

4. Tax Exemption to Individuals/HUF on investments in Equity Shares

Section 54 GB exempts taxes on long-term capital gains for the sale of residential properties. It is applicable when gains are invested in the Smaller and Medium Enterprises Act, 2006. Recently the section has been amended to include exemption on capital gains invested in the start-ups.

Individuals or HUF’s sell residential property and invest in the capital gains to subscribe 50% or more equity shares for the start-ups. In this case, tax on long-term capital gains will be exempt provided these shares remain unsold or not transferred within the five years from the date of acquisition. The start-ups can also benefit from the amount invested on purchasing assets, provided they have not transferred assets purchased within five years from the date of purchase.

This scheme under GST aims to boost investments for eligible start-ups to promote their growth and expansion.

5. Set-Off Carry Forward Losses & Capital Gains

Businesses can carry forward their losses if all the shareholders in an eligible start-up carrying the voting power on the day in which losses were incurred. GST has provided relaxations on the previous restriction of holding 51% of the voting rights remaining unchanged under Section 79 for eligible start-ups.

Consequences of Tax Evasion under GST Laws

The GST Council of India has now mandated e-invoicing and digital return filing processes to curb tax evasion. A practical implementation of GST law requires strict penalties against offenders. It is crucial to understand the know-how of the GST laws. Otherwise, start-ups and new businesses might have a hard time dealing with penalties. Here are some of the common offences under GST for small business in India and their penalties.

- Penalty for not registering under GST

10% or INR 10,000 penalty for tax due, whichever is higher.

- Penalty for not issuing GST invoices

10% or INR 10,000 penalty for tax due, whichever is higher.

- Penalty for not filing GST returns

10% or INR 10,000 penalty for tax due, whichever is higher.

- Penalty for committing fraud under GST

10% or INR 10,000 penalty for tax due, whichever is higher.

- Penalty for not filing GST returns in time

The late fee is INR 200/day (INR 100/day under the CGST Act & INR 100/day under the SGST Act) will be applicable up to a maximum fine of INR 5,000.

- Penalty for utilizing the composition scheme even though the start-up is not eligible

In case of fraud – as per Section 74, a penalty of INR 10,000 or 100% of the tax due (whichever is higher) will apply.

In case of no fraud – a penalty of INR 10,000 or 10% of the tax due (whichever is higher) will apply.

- Penalty for unlawfully charging higher GST rates

10% or INR 10,000 penalty for tax due, whichever is higher (in case additionally charged GST amount is not submitted to the government).

- Penalty for unlawfully charging lower GST rates

10% or INR 10,000 penalty for tax due, whichever is higher (in case additionally charged GST amount is not submitted to the government).

- Penalty for filing incorrect GST returns

A penalty of INR 25,000

- Penalty for issuing incorrect invoices

A penalty of INR 25,000

- Penalty for unlawfully charging the wrong GST type (IGST/CGST/SGST)

There is no penalty charged for this type of tax evasion. Businesses can pay the right GST amount and claim for a refund on the wrong GST payment made earlier.

How to Make the E-invoicing Process Easier for Start-ups?

The advent of the GST system in India has impacted mainly small businesses and start-ups. Most small businesses in India are still struggling to adapt to digital accounting processes. How can businesses issue correct e-invoices without hiring an accountant? Can companies successfully handle their financial operations without a dedicated accounting team?

The answer to these questions is Imprezz, the pioneer of invoicing and billing software in India. It is one of the leading business intelligence software that helps start-ups and small businesses generate GST-compliant invoices in just a few clicks. The software is a cost-effective replacement that allows new businesses to manage accounting without an accountant. Businesses can issue e-invoices in only three simple steps by using Imprezz accounting software.

Create the Invoice

The platform allows you to create multiple invoices in no time. You have to enter all the necessary details of goods or services supplied to the customer. The automated accounting system calculates the total value and helps you add the relevant GST rates applicable. The customizable templates enable you to edit the invoice template as per your business requirements. Once you have created the invoice, you can save and generate the invoice, ready for use.

Send Invoice to the Customer

After creating a GST compliant e-invoice, you can directly send it to your customer through email or SMS.

Receive Payment on Time

The invoice templates on Imprezz lets you link your bank account details. Your customer can immediately initiate the transaction and clear the invoice payment.

In addition to this, your customer can download and save the invoices for future reference. The software allows you to create and send invoices and helps manage various accounting tasks like tally, purchase order management, create and send quotations, import customer data, and more! The software also provides timely reports and business insights that fasten the decision-making process and develop business strategies.

Conclusion

Execution plays a vital role in bringing ideas to life. Similarly, GST plays the same position in implementing an effective tax system that intents to create a positive impact for businesses in India. Moreover, the new tax calculation system is better than the old, inefficient tax system as it is facilitative and efficient. It is fair to conclude that GST is playing a significant role in boosting start-ups in India to achieve its full potential.

If you are a new start-up struggling with accounting tasks, GST returns filing and adapting to the digital processes, let us run the errands for you. Imprezz accounting software enables you to issues bills and invoices in just a few clicks. Alongside, the software also helps file GST returns directly on the portal. Stay GST compliant, implement Imprezz GST billing software.

We offer a 14 days free trial software program for small businesses in India. Login to get started!

The advent of GST has led to significant changes in the way businesses operate across the nation. In the past few years, the need for corporate restructuring has increased the scope for transfer of business ownership. It is done majorly to increase the value of an enterprise, revive an organisation’s downfall, or gain an advantage over the competitors in the market. Either way, it is one of the extreme events, changes or decisions for a company.

Post COVID-19 economic crisis, organisations are primarily focusing on corporate restructuring through the transfer of existing business or a part of the business to another entity. Companies in India must evaluate the GST implications of transferring a business as per the recent tax relaxations. In this article, we have discussed the necessary implications and impacts of GST that might help business owners take significant decisions concerning business ownership changes.

Transfer of Business – Definition

Transfer of business is one of the basic accounting terms that define the action of transfer, assignment, conveyance, transmission or succession (by operation of law or by agreement) of the whole or significant part of a business, establishment or undertaking as per the applicability of this arrangement.

How to Transfer Business Ownership?

The means of transferring business ownership depends on whether a corporate entity is entirely up for sale, looking for partners/significant shareholders, or being taken over by a new member. Below, we have elaborated on the methods of transferring business ownership.

Partnership – Adding a New Partner

Adding a new partner is a go-to option for most MSME owners while transferring business ownership. Both parties have to follow the operating agreement, which describes; how to add a new partner to a small business idea. The agreement also states the ownership interests amount to be paid by the new partner entering into the business. The transaction is usually executed through payment in cash. However, other GST payment arrangements are also possible.

Sale of Business

Sale of business is initiated to revive the business’ value in the market. There are two effective methods to sell a private company.

Interested buyer can either pay via a loan or from his resources to be a company’s partner. The amount of money on each asset distributed is determined by the residual method for ordinary income and capital gains.

Financing sale is an instalment method of purchasing a company. In this payment method, owners offer to train the potential partner while paying for their share of ownership over a certain period. It is an effective method to avoid the default risk that occurs when a company borrows money from the banks. In this method, the default risk is forbidden as the buyer might forfeit the business back to the owner.

Leasing the Ownership

Lease-purchase enables the lessee to run the small business until the lease period expires. It is an ideal purchase method for the buyer as it rids the risk of making a wrong purchase decision. Once the lease ends, the buyer can either purchase the business for a set price or drop the idea. It allows the buyer to lease another company or only walkway by giving complete control back to the owner.

Transfer of Business to a Family Member

Most Indian communities follow this method, where they transfer the business’ ownership to one of their family members. Businesses run under family ties also benefit from the tax deductions. The government has a different set of tax rules for these ventures. It helps avoid the estate taxes at the death of the current owner. It enables the business to tap on the lifetime gift tax exemptions.

Impact of GST in Business Transfer

The new goods and services tax (GST) Act has altered tax procedures across the country. The impact of GST on the corporate transaction has primarily affected the fulfilment of mergers and acquisitions, arrangements, amalgamation, and takeovers. Thus, the corporate sectors must analyse the provisions of GST laws and rules and their impact on businesses.

Here, we have listed some of the crucial aspects impacted by GST in a business transfer.

1. Registration

The GST rule for business transfer under section 22 (3) of CGST Act 2017, states that a person buying the company in case of business transfer shall obtain a fresh certificate of ownership. The person is liable to register as the new owner and get the ownership certificate with the transfer date mentioned on it.

However, when a business is transferred due to an official order from the High Court or Tribunal, the transferee is liable to obtain the ownership certificate dated on the actual date of incorporation mention on the company’s registrar. As per section 22 (4) of CGST Act, 2017, the law states that the transferee shall do so under the order of High Court or Tribunal.

2. Input Tax Credit

Input Tax Credit is one of the most discussed topics among individual planning to take over an existing company? What happens to ITC when the business ownership is transferred? Under section 18 of the CGST Act, the GST rule specifies that the taxable person can avail of ITC.

Further, section (3) of CGST Act, 2017 under GST rule 41 specifies that, in case of a change in the constitution of a registered taxable person due to a merger, sales, demerger, amalgamation, leasing or transferring of business, the registered person is granted transfer ITC to the transferee. In case of a demerger, the ITC will be allocated as per the asset value ratio of each unit mentioned in the demerger scheme.

3. Itemized Transactions

What is an itemised transaction? It is defined as transferring assets and liabilities with assigned value on each item being transferred while transferring a business. Itemized transactions mainly concern the sale of particular items. Wherein, during a merger or acquisition, each item value is calculated separately. The transferee is liable to levy GST on itemised transactions; the sale covers the definition of goods as mentioned in Schedule II of the CGST Act.

4. Crash or Slump Sale

What happens when you purchase a company on a crash or slump sale? Generally, crash/slump sale is no different from regular sales; they are treated equally. The CGST Act states that the registered taxpayer is liable to pay the applicable taxes. In case of transfer of company ownership, the supplies including activities mentioned in Schedule II of the CGST Act 2017, (Notification No. 12/2017 Central Tax dated (Rate) 28.06.2017) are exempt from GST under transfer of going-concern either whole or independently.

No GST is applicable on crash/slump sale. Thus, as per the virtue of Re Rajeev Bansal and Sudershan Mittal (GST AAR Uttarakhand) Advance Ruling No 10/2019-20 (date of judgement 09.01.2020 mentioned herewith below), it can be concluded that the agreement of business transfer as a going concern consisting an under-construction project is exempted from GST.

5. Accountability of Businesses

At times, two or more small businesses in India merged or under the amalgamation/merger processes tend to involve exchanging goods or services before the date of enforcement ordered by the court or Tribunal for the transfer of business. Under such a scenario, the section 87 of CGST Act states that the companies are liable to pay tax on any such transaction of supply. The receipts shall either be included while calculating the turnover of supply or shall pay tax accordingly.

6. Trading Securities

Trading securities is one of the most common ways of acquiring a company. Buyer offers the shareholders to buy the securities of the transferor’s company at a specifically mentioned price. Trading securities is not considered as a transaction under GST. Thus, GST does not apply to the sale of securities.

GST Prospects & Implications on Business Transfer

The COVID-19 pandemic has caused chaos around the world. The disruption has caused a significant change in the economy, and the way businesses operate across the globe. However, on the other hand, it has also created tons of opportunities increasing the importance and flexibility of supreme businesses.

“Right time, right place and right opportunities”. It is the market condition that reflects the right time to leverage opportunities and exploit the ones at the bottom in any given situation. In the present-day scenario, businesses are determined, focused and consistently networking to assess various business niches and their performance. It helps them prepare themselves to sky-rocket their business both organically and inorganically through restructuring.

While the emerging prospects are floating across the tax system, MSME owners need to hunt for the opportunities and analyse the implication of GST on the transfer of business. Post COVID-19 pandemic, small businesses in India plan to retrieve their market value with a prospect to reinforce and grow amid. It is crucial to raise above the distress caused due to the adverse effects of the pandemic.

The information below is structured to provide detailed insights on the prospects of transferring business ownership and its tax implications.

Prospect 1: Transfer of Business as Going Concern

A running business capable of being owned and operated by the new owner/purchaser as an independent business, the transfer of ownership is listed under going-concern. As per this prospect, assets are sold as a part of the company when the purchaser intends to utilise the same resources to keep the business running and unchanged.

The internationally accepted guidelines of revenue and custom (referred by advance ruling authorities in India) also state that an enterprise should operate separately when only a part of the business is being sold. Further, the guidelines also forbid a series of immediate and consecutive transfers.

Tax Implication Under GST – Going Concern

When a running business is sold as going-concern, it is considered as a slump sale. Here’s how to analyse the relevant provisions of the GST law under such a scenario.

Provision No. 1

Schedule II of the CGST Act, 2017, states that the GST can be levied on the permanent transfer of business assets when a taxable person carries out the transaction; it is deemed to be performed by him in the course or before he transfers the ownership of another person. However, it is only applicable if the business is transferred as a going concern or a representative who is deemed the taxable person.

Provision No. 2

Serial No. 2 of Notification 12/2017 – Central Tax (Rate) dated 10-06-2017 states that the business as a going concern transferred either wholly or as an independent part is considered as the supply of service and its entire value is exempt from the levy of GST.

Explanation (Prospect 1)

The provisions mentioned above prove that the transfer of a business as a going concern includes the supply of services exempt from the levying GST on its transaction value. Concerning this, the GST Advance Ruling Authority (GST ARA) in India also runs the business transfer agreement analysis.

Prospect 2 – Transfer of Business as Itemized Sale of Assets

When a business is not transferred as a going concern, the assets and liabilities are transferred by allotting specific value to each item and is known as an itemised sale. As per this prospect, the slump sale, merger and amalgamation of business transfer are carried out item-wise where each asset’s value is calculated separately.

Tax Implication Under GST – Itemized Sale of Assets

As per the provisions mentioned above, under GST, the transfer of business assets is considered a supply. Goods that are a part of the business’ assets carried on by the taxable person is deemed to be supplied by him/her before the person ceases to be taxable. In simpler words, GST can be levied on itemised sales as per the GST rates applicable to the respective goods.

Prospect 3 – Transfer of Business as Sale of Securities

Sale of securities is one of the most common methods of transferring business ownership. As per this prospect, the share of the company on sale is transferred to the purchasing company. It is done by making an offer to the existing company’s shareholders with a specific price for the purpose.

Tax Implication Under GST – Sale of Securities

It is crucial to analyse the tax implications for this prospect as per the applicable GST provisions. Here’s how to analyse the relevant provisions of the GST law under the sale of securities.

Provision No. 1

Section 2 (52) of CGST Act, 2017 defines goods as a movable property excluding money and securities. However, it includes actionable claim, agriculture, or goods forming a part of the land either served or agreed to be served before supply or under a supply contract.

Provision No. 2

Section 2 (105) of CGST Act, 2017 defines services as activities that concern the use of money, or its conversion through cash or any other transaction mode from one form to another form of currency or denomination; they are charged separately. In simpler words, services are anything other than goods, securities and money.

Explanation (Prospect 3)

GST has been explicitly excluded for the transfer of securities. As per the Goods and Services (GST) law, the securities Contract/Regulations Act, 1956, securities transfer include scripts, derivative instruments, shares, bonds, etc. Thus, the transfer of business ownership through the sale of securities, including the shares is not subject to GST.

Conclusion

The introduction of the GST regime in India has wholly modified traditional tax methods. The unified tax system of accounts and records under GST has increased the clarity in a business transfer; enterprise owners can now rely on GST. Transfer of business via amalgamation merges, and other means do not attract tax liabilities under the GST law.

With the advent of GST, it has become crucial for businesses to consider the prospects of restructuring their enterprise. It is essential to thoroughly understand the availability of relevant credits of Input and Input services to check from the GST prospective. Transfer of business requires an in-depth study of cost benefits, GST implications and appropriate due diligence as per the business combination.

Implement Imprezz GST accounting software and stay GST compliant. The hassle-free software system offers a 14 days free trial program. Log in to leverage accounting automation.

Coming up with small business ideas and making it requires you to take actions. There’s a lot of thoughts that go into taking that call of making it happen. The success of your business is inversely proportional to the number of sales you crack every day. It involves a lot more than just trading goods for money. Emerging technologies have been remarkably helping businesses succeed, and it is high time to understand how to leverage accounting automation.

As a business owner, you need to puzzle out product merchandising, stock control, market research, advertising and marketing, customer service, negotiation and more. It doesn’t end there. You need to understand small business accounting; cash flow, taxes, payroll, tally, ledgers, purchase orders, and other accounting tasks need to be tracked carefully. You don’t want to let an entry slip away through the cracks.

In simpler words, the key to run a successful business is to keep detailed records, and that is where accounting automation software can help. This article is a part of our comprehensive small business guides – here’s how you can leverage accounting process automation in 2021.

What Is Accounting Automation?

Manual processes consumes most of an accountant’s workday. Accounting automation can complete the significant financial tasks automatically, or instantly. The concept of automation for small business in accounting is not entirely new; there have been different forms of computerised accounting systems since the late 1800s (source: https://www.accountingnotes.net).

Until recently, accounting automation tools were unable to work without human intervention. Accountants mostly operated them, and the manual operations still took a tremendous amount of time. Modern accounting automation has successfully removed these hassles by eliminating the least effective financial tasks. They provide more time for accountants to work on analysis, accounting strategies and other crucial business operations.

Automated software systems are advanced in crunching numbers and tracking each real-time transaction of a business. They have erased the need to build complex ledger files and countless rows and columns of data entry. Computerised software has built-in formulae that help create and send reports with the click of a button. AI in the field of finance strives to streamline the overall business operation by automating accounting processes.

Impact of Automation on Accounting

Several business organisations have been continuously seeking efficient results through fair use of accounting automation tools and services. According to one of the recent surveys, the accounting automation statistics suggest that a more significant number of transactions are being processed and reported automatically by AI machines (source: https://www.researchgate.net/). Modern AI software work alongside humans to make financial operations more effective and productive.

Several CFO’s are concerned about the impact of automation on customers. Recent reports estimate that more than 50% of the back-end functions can be potentially automated; except roles related to knowledge-base management and shared services (source: www.ibanet.org). That is professionals, including the data scientists, cognitive tech geeks who can convert insights into meaningful communication.

Several big businesses and CFO’s are now focused on utilising this opportunity by identifying individuals who are passionate to learn and expand their skill sets in the process of becoming the real business-minded partners. Today’s business world needs the next generation leaders capable of driving changes that can reshape how accounting operations are done.

What Is Accounting Automation Software?

The practical results of implementing accounting automation are beyond learning accounting or cloud accounting. Automated accounting is more potent than the traditional computerised system. Employing an automated system rids accountants from performing manual data entries or 3-way data matching.

Business automation tools automate a significant part of small business accounts payable processes. It automates everything from recording each transaction to GST returns filing procedures. Accounting automation software might require humans to intervene only when there are certain exceptions or need a higher level of thinking.

What Are the Benefits of Using Automated Accounting Software?

Automation in finance resolves the manual accounting hazards through smart software solutions that can instantly take care of the problem. If you are a small business wondering how accounting automation can benefit your enterprise, here’s a curated list that answers all your questions.

Strategic Management of Cash Flow

Mismanaging cash flow is one of the primary reasons why businesses go bankrupt. Cash flow crisis mostly arises due to inadequate accounting protocols that are unhealthy to a company. These protocols limit an enterprise from scaling and expanding their business. On the other hand, automation focuses on strategically managing cash flow that immediately provides a clear picture of business funds.

Automation allows business owners to quickly estimate their profits; where is the business spending the most, when can the company expect income. They no longer have to create manual reports to know their financial position. It provides visibility that contributes to making critical decisions when necessary.

Saving Time Through Automation

Automation is generally known to save time and manual efforts across various industries. Likewise, in accounting, automation allows accountants to conveniently work on ledger entries, client information and other financial details. They no longer need to spend countless hours trying to interpret data or matching them.

Automated accounting systems auto-updates each record and relates the existing data in no time. Further, the systems also generate structured financial reports and install accurate timestamps on the related data. Soon, automated accounting software might replace the need for manual data configuration as well.

Advanced Cloud Access

Businesses using cloud programs can never settle for anything less. It is much easier to work when data access and document sharing is just one click away. Accountants and business owners can immediately process transactions and analyse each document anytime, anywhere. Cloud systems like Imprezz makes it easier to work as a team with shared data access.

Cloud accounting software is comparatively much secure to manage accounts payable; it is purpose-built for professionals with round the clock data access. They strive to provide the highest safety and enterprise-grade data security standards to keep the business operations streamlined.

Flexible Features & System Functionality

Supreme quality accounting software provides features that are adaptable enough to sync with various business requirements. Implementing an accounting system that can adapt to the everchanging business environment is crucial for enterprises to succeed amid challenging competitors.

An integrated software system like Imprezz allows standard formatting and provides customisable templates to formulate different business ledgers. These are some of the vibrant features and functionalities that make accounting software highly flexible for a wide range of businesses and industries.

Cloud Storage & Data Organization

Automated accounting platforms are capable of elevating businesses beyond their current capabilities. Data organisation becomes easier with accurate data entry, processing and storage. Business operations become significantly convenient when you know where to locate specific information precisely.

Automated accounting software guarantees streamlined data. It automatically saves the details by immediately identifying the information entered in the database. Advanced computerised systems like Imprezz offers secure cloud accounting that helps perform automatic, regular back-ups to prevent businesses from losing crucial data.

Enhances Data Security

On the dark side, the internet of things has made it difficult for businesses to survive. Although there are various advancements in today’s technology, the chances of being harmed by cyberattacks are equivalently high. Accounting automation is built with encryption technology that offers advanced security features to ensure maximum business data protection.

Alongside protecting businesses from being hacked, automated platforms enable business owners to control the shared data access, allowing them to share what is necessary. The feature helps maintain the confidentiality of ledger information by preventing the unauthorised employee from accessing the information.

Quick Data Recovery

Physical storage of paper files can be a daunting task; data storage can slowly turn into countless records. The thought of retrieving or reviewing physically stored data can haunt accountants. They have to search for each document, sometimes piled in different rooms to match them and interpret the data.

Accounting automation is a boon to accountants; it is effortless to find records online. Instant location of files, entries and records has never been this easy before. Automated systems are programmed to make ledgers and document reporting easier to categorise and store safely.

Comprehensive Data Analysis

Besides offering data security and organisation, modern accounting platforms also supports quick presentation and distribution of financial data. Analysed files can be accessed by any individual working in the enterprise; making reconciliation of audits and records much more manageable.

Furthermore, analysing trends becomes easier with accurate means to check variances and predictability feature offered by the software. It enables accountants to make data-driven, smart business decisions by providing access to readily available reports.

Tax Compliance & Deductions

The advent of the GST regime in India has made returns filing mandatory for registered businesses. The recent tax relaxations have led to confusion. Business owners are struggling with sales tax deductions during the tax seasons. Running errands with tracking receipts and expenses might lead to mistakes that can have severe consequences.

The rise of automation in bookkeeping has eliminated the hassles of GST returns filing. Accounting platforms are now capable of updating records immediately as the transaction is processed. Accountants need not enter information as real-time accounting systems auto-update transaction data. They need to have an eye on these details to make sure if the information is accurate.

Automated GST accounting software like Imprezz are capable of figuring the deductibles. It allows the business owners to understand and estimate the tax preparation time immediately after processing the transaction.

Professional Development & Expert Learning

Any job role requiring manual, repetitive work can be replaced with the right tools and automation. In finance, accountants can easily replace their traditional, regular-basis work through automated accounting systems. It enables accountants to be more productive as they are free to focus on personal development and other efficient tasks.

Despite all the advancements, accounting platforms do require human intervention. Accountants must ensure that these applications are working accordingly from time-to-time. Automation has been a turning point in the career of every accountant. It helps enrich their employment experience, improve their value within an organisation, and share their knowledge.

Implementing an ideal accounting platform can eliminate the most tedious and frustrating accounting tasks. It must allow business owners to better focus on other crucial business operations, such as managing the bank accounts, developing business and accounting strategies, and better communication with the employees.

How to Select Best Accounting Automation Software?

Automated accounting systems aren’t just for accounting. Business owners must know how to leverage accounting automation by integrating various business functions under a single platform. Instead, they should look up for software programs offering integrated business intelligence tools that help manage other aspects of the business.

For instance, Imprezz integrated system allows businesses to leverage invoicing and quotation maker feature as a marketing tool. The software also integrates various essential tools like tally, purchase order management, import functions under a single platform.

Here’s a curated list of what to look for when you decide to purchase accounting software.

1. Does the software work well for your business requirements?

Before taking the call on buying software, make sure if the accounting system is designed to make ends meet for your business. You can refer to online forums and detailed specifications to understand the functionalities of the software.

2. Does the software offer multiple access levels?

As discussed earlier, it is best to implement different data access levels for owners, managers, employees and other authorities. You don’t want all your employees having easy access to your accounts data.

3. Is the software capable of recording transactions and managing the payroll system?

Although any accounting platform is capable of recording transaction, not many systems offer payroll management. Most software offer payroll as an upgraded feature. Please check for the features before you purchase the software.

4. Does the software offer inventory tracking?

Only some software features include inventory tracking; others don’t. You do not want to link other tracking apps to your main accounting software. It will just multiply the amount of money you will have to spend on automating your accounting processes. Do thorough research about the software features, but what is useful for your business. Do not pay for unnecessary features.

5. Is it a cloud-based software?

We have already discussed the detailed benefits of cloud system in the article above. If the software is cloud-based, it will provide remote access. You will have the freedom to work from anywhere. It also offers lower support costs, automatic back-up facility and hassle-free integration for payment and other applications.

6. Is the software extensible and scalable?

Small businesses have a greater scope of expanding with time. Thus, it is crucial to implement a scalable remote business accounting system, a software that can grow as the business does. Scalable software feature enables businesses to add new users as they expand. Wherein, the extensible feature allows users to purchase new add-on applications.

Regardless of which accounting software you choose to purchase; ensure you always keep your essential files archived. Do not share the access for your data concerning sales records, bank information, loan statements and tax data. These crucial documents play a vital role in formulating tax returns and business audits.

Quick Tips for Successful Small Business Accounting

Using your accounting software to accomplish your regular business operations will help you get the best results. Here’s a list of quick tips, make this your daily accounting small business checklist, so you don’t miss out on anything.

- Record Each Transaction

- Check & Reconcile

- Review the Difference b/w Incoming & Outgoing Cashflow

- Collect Required Tax Data

- Cross-Check the Defined Ledgers

- Keep Your Ledger Entries Updated

- Get an Outside Perspective from Your Financial Advisor

- Create Regular Reports

- Keep a Trail of Paper Records (Receipts & Invoices)

- Do Not Intermix Your Personal Accounts & Business Accounts

- Stay GST Compliant – File Returns On-Time

- Watch Your Business Cash Flow

Combination of Automated Accounting & Smart Spending Software

By now, the reasons why your business finances require automation must be pretty clear. Accounting software saves time, avoids manual errors, and keeps business documents at your fingertips. There’s no excuse for not implementing accounting software.

Alongside enjoying the benefits of implementing accounting software, have you considered leveraging automation to track your expenditures? While giving your finance team a customised control over your finances, you can also deal with your expenses in the same manner.

Combining accounting and expense tracking features makes your business operations more efficient, accurate and help confidently deal with your accounts at the end of every quarter. But the question remains; how to combine both functions? If you do not know where to start, consider implementing Imprezz accounting software, a complete package of business intelligence tools—leverage automation in every way possible. The software offers features that can help beyond your accounting needs.

Will Automated Accounting Software Replace CPA’s?

Automation replacing accountants in the near future is a mere myth. As we advance, businesses are still going to require accountants to ensure cost efficiency and effectiveness. Although automation simplifies a large role of accountants, it cannot entirely act like an accountant. Instead, it is the modernisation of the traditional practices of accounting which allows accountants to make exceptional advancements in their profession.

Automation in accounting has increased the scope for accountants. It has eliminated their need to spend enormous time doing the tedious yet essential accounting tasks; enabling them to limit their errors and provide accurate results. Accountants can now work on their vital roles as financial officers. They can further become finance consultants who create strategies, budgets and advice the CEO’s to help increase their organisation’ overall profits.

The emergence of advanced technology does not mean businesses can do away with employing humans. They still need bookkeepers who can understand the fundamentals of accounting, analysing and explaining how finance works for an enterprise. Businesses do require individuals who are capable of doing more than just interpreting financial data. Accounting software has transformed CPA’s into custodians of financial information.

Most people believe that AI (Artificial Intelligence) and machine learning will take over employees’ roles. However, it is far from the truth. In accounting, businesses will always require an expert to keep an eye over software functionalities. All-in-all, AI has increased CPA’s efficiency by enabling them to deal with numbers much faster and in more accurate ways. The process of strategic decision making is now easier than ever for CPA’s.

Business Automation Guide – Cut Short!

Having known the basics of accounting automation, here’s a list of new strategies working great for businesses in 2021.

- Automate transaction accounting tasks (bookkeeping, payroll, purchase order, etc.)

- Automate your business cash flow, tax calculation, planning and tax research.

- Automate accounts and records under GST.

- Leverage AI right away and save yourself loads of time.

- Auto-verify data to keep up with the quality.

- Become an automated and fully outsourced accounting professional for your clients (forecasting, financial modelling, business planning and more).

- Pick financial service providers who offer most accounting automation features and capabilities.

Conclusion

Technology has enabled business owners to manage their enterprise more efficiently. As a result of automation, the business now has an easy means to perform improved data analysis and reporting. Ideal accounting platforms enables business owners to see the overall business performance. If your company still adheres to manual accounting processes, you are running last in the race.

Automation enables you to keep your fingertips on the pulse of your business, helping you to meet the everchanging demands in the marketplace. We hope this guide to accounting automation – 2021 was helpful for your business. Now we leave it all over to you.

Do you want to install strategic accounting software for your business? Implement Imprezz, pioneer of business intelligence software for small businesses in India. The company has been helping MSMEs in India succeed despite the everchanging business environment. The platform has been helping several small businesses sustain despite the economic crisis caused due to COVID-19.

We offer a 14 days free trial software program. Login to automate your transactional works and financial advisory right away!

Accounting is one of the most discussed topics in the world of business. Not only business owners, but even a regular employee is also familiar with accounting. They send bills, keep a record of profits, losses, and costs. Every business is involved in some form of accounting irrespective of its scale. Understanding accounting basics under GST is necessary to manage finances for your business and personal life.

Statistics prove that 82% of all businesses mostly fail due to inadequate or insufficient cash flow management. About 99.7% of small companies are more likely to encounter negative cash flow management (source: https://www.smallbizgenius.net). Accounting indeed seems to be a daunting task. However, here’s a comprehensive COVID-19 guide to accounting basics; become your own accountant.

In this article, you will learn the concept of the accounting system, accounting principles, importance of accounting, and small business accounting 101 checklists to help you start or grow your small business ideas.

Basics of Financial Accounting for Entrepreneurs & Business Owners

Business owners or entrepreneurs cannot rely on accountants entirely; they need to make sure they are doing it right. Managing cash flow requires a basic understanding of accounting fundamentals, importance and types. We have coupled a list of topics that will help you better understand the basics of finances.

Basic Accounting Principles

Accountants or businesses must adhere to a particular set of rules and benchmarks while reporting financial statements. The common set of accounting standards accepted universally are known as accounting principles. Although each country’s accounting principles differ, they are mostly noticed to be of the same fashion.

Accounting standards are framed to ensure that the principles of reporting financial statements are understandable for businesses across the world. Here’s a list of Generally Accepted Accounting Principles (GAAP) that every business owner should know.

1. Economic Entity

The principle states that the owner and the business are two different entities; each carries various liabilities.

2. Revenue Recognition

The principle ensures that the revenue generated by a business is recognised on the accrual basis of accounting.

3. Conservatism

The principle suggests accountants and businesses adopt the most unfavourable option under a situation where there is more than one acceptable option for reporting.

4. Consistency

The principle states that any business can break the consistent usage of accounting methods when another exemplary method is better.

5. Historical Costs

The principle of historical costs mandates businesses to record their assets under the purchased values; whether assets were brought now or years ago.

6. Full Disclosure

The principle ensures that an enterprise provides full disclosure of all the necessary information concerning its users, investors or lenders in the financial statements as a footnote.

7. Going-Concern

The principle states that no business shall be forbidden from continuing forever. They can continue to achieve their goals and plans in the foreseeable future without intending to liquidate the enterprise.

8. Matching Concept

The principle ensures that the debit side of the financial statements matches with the credit side.

9. Materiality

The principle states that financial information with a material effect should form a part of the financial statements.

10. Monetary Unit

The principle states that only transactions stated in terms of currency with a monetary value should be recorded in the business accounts.

11. Reliability

The principle states that businesses must only record transactions that can be proven and carry significance evidence.

12. Revenue Recognition

The principle states that businesses’ revenue must be recognised on the occurrence of transactions regardless of the amount on actual receipts.

13. Time Period

The principal sets the standardised time period for reporting financial statements, i.e., monthly, quarterly or annually.

Read the detailed description of accounting principles’ various subjects, click here – Basic Accounting Principles for Beginners.

Importance of Accounting – Steps to Accounting 101

For businesses, accounting is more or less like the heart of a body. Managing finances effectively helps keep the business alive. Practical accounting is crucial to incorporate or grow a business successfully. What are the basic accounting procedures? How do you know if you are doing your accounting right? While there are several tips for money management available online, who has the time to examine them all?

Small businesses around the world can manage their financial operations effectively by implementing advanced accounting software like Imprezz. It helps business owners better focus on other crucial areas of business operations. However, small business accounting can be nailed by following a step-by-step guide to success. Here are seven significant steps to basic small business accounting.

Determine the Type of Business Entity

It is crucial to determining the entity type that best suits your business objectives before incorporation. Based on the complete information, it is ideal to ask for insights from a Certified Public Accountant (CPA). It can help in making the right financial decisions concerning the long-term tax implications and legal obligations.

Open a Bank Account Dedicated for Your Business

Never intermix your funds with business funds. Setting up a separate business account is a smart way to keep track of your business’ revenue generation. Moreover, it also streamlines the processes of managing your books and funds from a legal standpoint.

Set-Up an Accounting Software or Hire an Accountant

Businesses must analyse, track and report each transaction at the time of occurrence. Several software programs offer business intelligence tools, and it is one of the best ways to manage your accounting operations. You can choose Imprezz GST billing software, an integrated accounting platform your business must-have. Otherwise, you can also opt for outsourcing or bookkeeping methods for your business.

Track Your Business Expenses

Money is the fuel that keeps the business running; many expenses incurred while starting or growing a business. It is crucial to record all the necessary bills, documents, and receipts, including the expenditure of meals, business travels, goodies, and gifts.

Establish Budget & Forecast

Financial health primarily depends on money management. Thus, start-ups must have an estimation of incurring and outgoing expenditure for their businesses both in short-run and future. It helps business owners set their organisation goals accordingly.

Get-Going with a Payroll System

Payroll system plays a crucial role in paying employees and yourself. You cannot pay your employees casually through fund transfer or by writing a cheque. Several business intelligence software offers payroll management system. Otherwise, you can also outsource payroll management depending on the number of employees working at your firm.

Understand GST Requirements of Your Business

Your business must always comply with GST from day one. The Indian government has strict implications of GST that every registered company must follow. Do you run an unregistered business in India? It’s time for you to register your business and enjoy the tax benefits. Read more about the online GST registration process on our blog section.

Being well versed with your tax requirements include understanding the sales tax requirements, tax payment schedule and GST laws and rules. Tax schedule alone differs depending on your tax entity, business income, and tax payable to the government.

Personal Accounting

Personal accounts are related to individuals, companies, firms, corporates, group of association, etc. It may either belong to a natural person, artificial person or representative person. Personal accounting is carried out with the principle “debit the receiver, credit the giver”. With the implementation of a personal accounting information system, you will better understand your finances.

Daily Accounting

Bookkeeping is the process of recording each transaction daily, as and when it occurs. Recording daily accounting activities in an accounting system enables business owners to track their income and expenses that is crucial to draft financial statements and analysing the metrics of business finances.

Daily accounting involves various accounting tasks. Here’s a to-do list for your business’ daily accounts management.

- Refresh Your Financial Data

- Review & Reconcile Each Transaction

- Record Payments Received

- Track Your Accounts (Accounts Payable & Receivables)

- Record Inventories in the System

- Create and Send Invoices to Your Clients

- Pay/Schedule Your Payments

- Back-Up Your Financial Data

Online Accounting

You can either handle your accounts manually or by using Internet technologies. Online accounting is known as the most effective bookkeeping methods. Unlike manual recording, it offers error-free invoicing and GST returns filing. The modern online accounting system has successfully replaced traditional software, spreadsheets and manual paper-based accounting.

Accounting Vocabulary

Nailing the secret language of the accounting world is crucial to sustaining in the business. It would help if you familiarised yourself with the most common accounting terminologies to have a successful accounting career. To help you get started, we have listed some of the commonly used accounting terms.

- Accounts Receivable (AR)

- Accounting (ACCG)

- Accounts Payable (AP)

- Assets (Fixed and Current) (FA, CA)

- Asset Classes

- Balance Sheet (BS)

- Capital (CAP)

- Cash Flow

- Certified Public Accountant (CPA)

- Cost of Goods Sold (COGS)

- Credit

- Debit

- Diversification

- Enrolled Agent (EA)

- Expenses

- Equity

- Insolvency

- Generally Accepted Accounting Principles (GAAP)

- General Ledger (GL)

- Trial Balance

- Liabilities (Long Term & Current)

- Limited Liability Company (LLC)

- Net Income (NI)

- Profit & Loss Statement (P&L)

- Present value (PV)

- Return on Investment (ROI)

- Bonds & Coupons (B&C)

Do you want to have a clear understanding of accounting terms? Read more on – Definition of commonly used basic accounting terms – part-1 & part-2

Conclusion

Small business accounting might seem like a daunting task, but the efforts are always worth it. Accounting not only helps track your income and expenses; it also enables you to see the big picture. Accounting influences most of the critical business decisions. Be it simple calculations or understanding the tax obligations, master accounting disciplines by implementing ideal accounting software.

Imprezz is an online invoicing and billing platform; helping businesses stay GST compliant. Implement the software, and your business will thank you. We offer a 14 days free trial software program – Log in to get started.